Brett Knowles, pm2 Consulting

Brett is a long-time thought leader in the Strategy Execution space for high-tech organizations, beginning in the late 80’s while teaching at Harvard and being involved in the initial Balanced Scorecard research and books. His client work has been published in Harvard Business Review, Forbes, Fortune and countless other business publications.

Pub: April 20 2021

Upd: November 14 2022

Beyond assessing and gauging expenses, revenue, and cash flow of the company as a whole, they must be accountable for analyzing the financial health of individual departments. Financial processes are made simpler with OKRs due to the requirement of extensive number crunching and assessment of financial strategies.

Everything Old is New Again.

Once a client asked me, "What role do OKRs play in the financial planning process?" My knee-jerk answer was that OKRs and Financial Planning are two sides of the same coin. He asked for an explanation, which I did not do justice to at the time. But this was a great question and was something that (I thought) I had not considered. I decided that it deserved a better answer.

I began doing some research to see what had been written on the topic so far. Much to my surprise, I found the best answer (I think) was in work that I was involved in at The Balanced Scorecard Collaborative in the late 90's.

What you will find below is an abbreviated version of our 90's research, restated for OKRs.

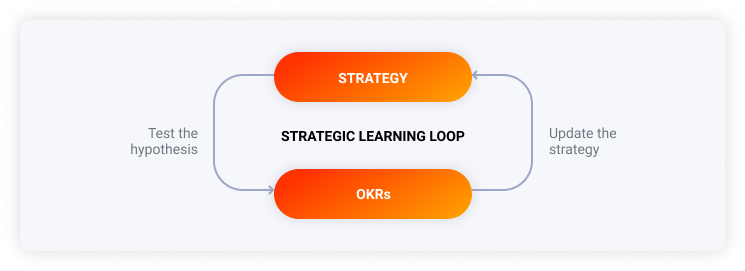

Step 1

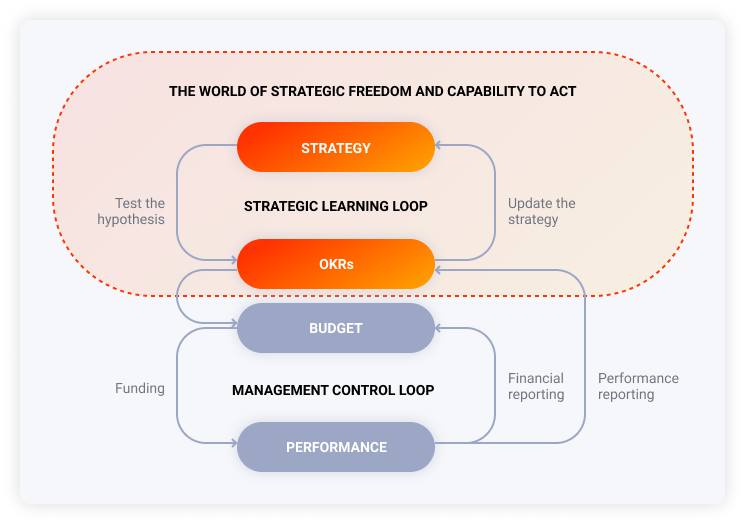

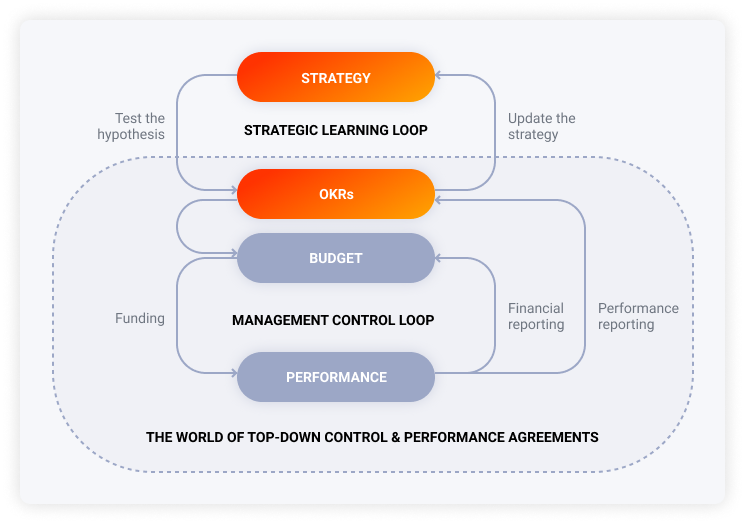

The start of any financial planning process is your strategy - what people these days are calling your "North Star". From the strategy we need to develop our OKRs answering:

- What do we need to do this quarter to move towards our longer-term strategy? (Your Objective)

- What would I see more of, or less of, as we work towards that Objective? (Your Key Results)

The forming of your OKRs (the 'test the hypothesis’ arrow) allows the organization to test your strategic hypothesis. Based on what the organization thinks that it can do, the strategy should be refined (the 'update strategy' arrow).

In total, this becomes the Strategic Learning Loop (but there is more to come on that process...).

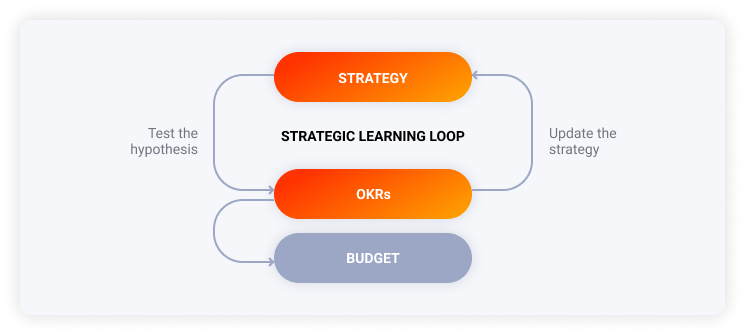

Step 2

Once you have settled on the strategy and the resulting top-level OKRs, we can use the OKRs to inform the budget. Only about 25% of the OKRs will have budget numbers associated with them, but the linkage between the majority of your OKRs and the budget is critical to strategy execution.

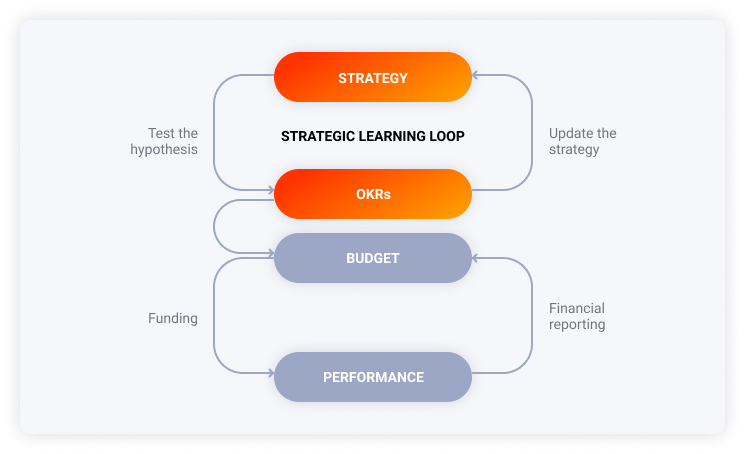

Step 3

So the budget funds the departments and processes to get work done. Their financial performance informs the budget and financial world of what has occurred. This is the financial reporting process.

Step 4 (this is the important one)

There is a critical second feedback loop - how we are doing against our OKRs: This is the performance reporting process (the new arrow on the right). This feedback completes the Management Control Loop.

The OKR performance reporting process is core to the double-loop learning required to develop agile management practices and to successfully execute on your strategy. Based on what performance has actually occurred, you will need to modify your strategy (before the next annual cycle) to take into account what is really happening in the business.

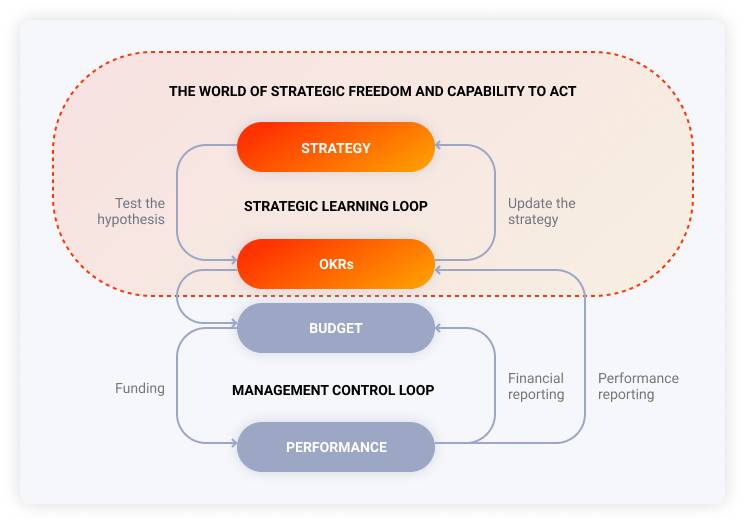

The big(ger) picture

The top of this chart represents strategic freedom - the opportunity to create the dream (and the North Star).

The bottom of the chart represents the grant of authority and service-level agreements you make with Finance and the other departments, teams, and individuals.

The OKR - Financial Planning Venn Diagram

(What would a slide deck be without a Venn diagram?)

OKRs are the connection that translates strategy into action. They are the only element that is part of both the Strategic Planning Process and the Financial Planning Process. They are the critical translator and feedback hub.

Is there anything more?

I think this is fairly explanatory. Executing successful financial strategies doesn’t have to be as complicated as you thought. Remember that when using Hirebook you get top-notch OKR software to help you track your objectives and key results easily and successfully. We hope that this article comes in handy when creating your next financial plan!

Photo Credit - jcomp

- Relevant

- Recent

- Topics

- Archive

- April 2023 (1)

- March 2023 (1)

- June 2022 (1)

- May 2022 (3)

- April 2022 (3)

- March 2022 (5)

- February 2022 (2)

- January 2022 (3)

- December 2021 (3)

- November 2021 (4)

- October 2021 (5)

- September 2021 (8)

- August 2021 (7)

- July 2021 (2)

- June 2021 (3)

- May 2021 (5)

- April 2021 (8)

- March 2021 (4)

- February 2021 (3)

- January 2021 (3)

- December 2020 (6)

- November 2020 (9)

- October 2020 (1)

- September 2020 (5)

- August 2020 (4)

- July 2020 (1)

Discover More Hirebook Posts