Laura Iñiguez, Content Manager at Hirebook

Laura is a content and social media strategist with deep experience in Employee Engagement, People Management, and Culture. She works with Hirebook to bring their innovative best practices to life through content, videos, and webinars seen by thousands around the globe.

Pub: November 24 2020

Upd: June 20 2023

Even though it may seem “revenue” is the most important thing to measure, it should not be the one you pay the most attention to, there are other factors that can influence this specific metric or that have a part in your company’s growth and success. Evolution is an essential part of growing, so as your business grows, your growth metrics should evolve with it.

Keeping track of what makes your business successful and knowing how to maintain and improve those numbers is what will help you attract more investors and what eventually will help you succeed. You just need to know how to adapt and make the best out of the usual growth metrics every business measures and adapt them to your business model. That’s why today we provide you with our key startup metrics to measure growth.

1. Customer Acquisition Cost (CAC)

Basically, the cost of acquiring a new customer. Customer acquisition cost CAC is one of the most important growth metrics for an early and growing startup company since customers are the ones generating revenue. But getting customers to buy and trust in your product can be a bit expensive and you must verify if what you’re spending on getting customers is being or will be profitable soon. You’re probably going to be unprofitable for some time, but how much time can you devote to being unprofitable before you become profitable?

To calculate your customer acquisition cost, pick a specific time period, like a quarter, and then divide your cost of marketing and sales by the number of customers you gained during that period. For example, if your sales and marketing expenses were $100 and you gained 4 customers, your Customer Acquisition Cost is $25 per quarter.

Clearly, the lower your customer acquisition cost the better, but it’s perfectly normal to have a high CAC at first when you’re trying to get noticed by your target customers, the challenge here is to lower your CAC so it becomes profitable. Unless you launched a new product or service that required a whole new campaign, a Customer Acquisition Cost on the rise is a crystal sign of danger and that you won’t be able to keep the ship above water for long.

2. Retention Rate

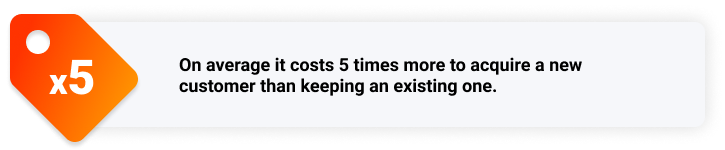

Don’t get obsessed with just acquiring new customers. It’s important to nurture the customers you already have, otherwise they’ll eventually feel abandoned and not cared for and will probably take their business elsewhere. Think about your CAC, think about how much it is costing you to acquire a new customer to later neglect them just to spend more money on getting a new customer. Doesn’t sound profitable, right?

According to Invesp, about 44% of companies maintain a greater focus on acquiring new customers vs. 18% that focus on retention. Also:

To calculate your retention rate, again you need to pick a specific time period and then subtract the number of new customers from the total amount of customers and divide that number by the number of customers you started that time period with. For example, if you started your quarter with 100 customers, got 20 new ones but you lost 5, you finished that quarter with 115 customers; now subtract the number of new customers (20) and you got 95, divide that by the number of customers you had at the beginning (100) and it equals 0.95, so basically your Retention Rate is 95%. The higher this number, the better!

Retained customers are not always buying customers. According to NP Digital founder Neil Patel, there are 3 kinds of customers you need to focus on:

- Current - Customers that are using your product regularly.

- Inactive - Customers who have stopped using your product or have slowed down their use of it.

- Churn - Customers that completely stop using your product.

Measuring retention won’t always give you a fair scope of those customers you’ve lost. Losing customers is something that is going to happen from time to time, no way to avoid this, but it’s important to put special emphasis on not losing more than you can handle to keep the company afloat.

Measuring customer churn rate is easier number-wise but not business-wise. To calculate it simply divide the number of customers you lost by the number of customers you started a time period with, the resulting percentage is your customer churn rate.

To measure your customer churn rate, some startups prefer to wait a little longer so as to not confuse attrition customers with inactive ones. But losing customers is definitely not the end of the world, you are still 2 times more likely to recover a lost customer than closing a new one! But it takes a little effort. Always ask your customers what you could do to improve, people love giving their insights, especially if they might actually get some benefit from it. Just because you have active customers doesn’t mean they don’t have anything to say, don’t just ask customers when they leave you or when they slow their usage of your product; try to regularly ask all of them if there is something they’d like you to do better. You can create some online surveys, get a local phone number to have a more personal approach, and call them. There is always room for improvement.

3. Customer Lifetime Revenue

Or Customer Lifetime Value measures the revenue you get from ongoing customers. This metric could be a little tough to measure at the beginning, but as you collect data, it will get easier to determine how much you can receive from a customer during the time they’re with your company.

For example, if an average customer stays with you for 2 years, you can calculate CLR by multiplying the monthly revenue from a specific customer by the number of months you expect them to stay with you. It’s important to know that your CAC should be way lower than your CLR, having steady clients providing high revenue will give you a good vision of how much you can spend on acquiring new customers.

Measuring CLR can also help you improve your retention rate; if your CLR is high then you’re probably on the right track regarding your product and/or customer service, but we still encourage you to ask your customers for feedback.

4. Viral Coefficient

This metric is focused on measuring your organic growth. When trying to launch your product, you’re probably going to share it with friends and close acquaintances, if they like it, they’re going to share it and invite others to use it as well, You can also find influencers to optimize this process, generating a healthy and organic word of mouth advertising.

Another way to reach a broader audience is by using social media. To calculate your Viral Coefficient you need to have your initial amount of customers (before starting sharing it), the number of invites sent to potential customers, and the percentage of acquired customers through those invites. This rate over several cycles is your Viral Coefficient. You can also use social media scheduler to reach a broader audience.

Viral Coefficient will allow you to see if your product has a positive response and therefore if it’s eventually going to be profitable. you can also get genuine Instagram likes from credible sources to support these reviews. It will also help you with managing the next metric:

5. Return on Advertising

They say the best advertising is word of mouth, and though that might be true and it’s also free, it’s very hard to get people to talk about your product. If you’re a startup, you surely need to have an advertising budget to move your product and take it to the right audience, expecting a fair return of it. ROA calculates such a return, just divide the number of sales that came from your advertising spending over a period of time.

If during 6 months you spent $1,000 and made $5,000 in sales, your ROA is $5, you gained $5 for every $1 you spent on advertising.

Knowing your Viral Coefficient will help you determine how much to spend on advertising when first trying it out, we recommend that you don’t go all in and to not try several channels at once, no matter how positive your Viral Coefficient is. Start low and then grow it progressively, if you start using just one channel, it’ll be easier to calculate your ROA. As you get the hang of it, you’ll be able to grow and expand.

6. Referral

This might be similar to your Viral Coefficient metric but it’s very important to measure your referral rate aside. Have you ever noticed when buying something online you get a small survey asking how did you find out about the product? Well, that’s the company measuring their referral rate.

But why is it important to measure aside? Well, basically because the higher your referral rate, the lower your CAC! A good way to ensure referrals is by implementing a referral program, you would get more customers and still have a low CAC. Hirebook’s Expert Program offers recurring revenue to our Experts while sharing best practices and modern methodology in Employee Engagement.

7. Monthly Recurring Revenue

Basically, this is a measurement of how much revenue your customers generate in one month, either new users or monthly active users. Yes, this could be the most important one since it will determine the future of your company by just measuring whether you’re making money or not. Measuring revenue is not the same for every company, it depends on the product you sell and if said product or service has additional fees or some discounts for early payment, etc. But still, it’s a number that should be monitored consistently.

MRR is one of the major startup metrics to keep an eye on. It will help you understand your company’s growth, the market, and even predict future revenue (considering your Customer Acquisition Costs and Churn rates are on point).

The easiest way to calculate your average monthly revenue is to summarize the revenue you receive from paying customers each month. But, as we said, it’s different for each company, sometimes you’ll also need to consider the following:

- New MRR, revenue that is gained only from new customers each month.

- Add-on MRR, revenue from existing customers that buy additional features or upgrades.

- Revenue Churn Rate, the monthly revenue from lost or downgraded customers.

The sum of these recurring revenue metrics determines the net MRR. So, if your revenue churn rate is higher than your new monthly revenue, your company is facing trouble, For example a failing Ecommerce, it is suggested to review the valuation of the Ecommerce business before you contemplate an exit.

Revenue is the most difficult to obtain, especially when starting a business, and setting up a limited company. so it’s very important to keep a close eye on your marketing and sales metrics and create strategies that’ll allow you to grow gradually and in a steady way. You can maybe ask for some payments in advance, offering a yearly discount when paying the whole year instead of requesting monthly payments is a great way to do so; strategies like these can help you maintain a steady revenue and help you strategize your growth.

If your company offers yearly contracts, you should probably focus on the annual recurring revenue and annual contract value to measure your customer’s value per year.

8. Burn Rate

Burn rate indicates how fast your Startup is spending money. This metric helps you calculate your cash runway so you can decide if you want to cut costs or invest a little more in processes like marketing or hiring new talent. It’s quite important to check your burn rate often to be aware of leakages or anything else that might indicate your business is spending money on unimportant expenses.

To calculate your Burn rate, you take the total amount of money you had at the beginning of the month and just subtract the total amount of money you end up with at the end of the month, that is your burn rate.

9. Cash Runway

When it comes to startup metrics, this is one you can’t set aside. If you want to calculate how long your money is going to last this is the metric to help you with that. This way you can determine if you need to improve your fundraising efforts, cut some expenses or come up with a better sales strategy.

To calculate your cash runway, divide your cash balance by your monthly burn rate. Keep in mind it’s better to track your sales pipeline alongside your cash runway to have a better picture of your company’s cash flow.

10. Lead Velocity Rate

LVR is the month-over-month (MOM) growth of quality leads in your sales pipeline. It can help indicate future growth by giving you an idea of future deals. By comparing the LVR rate to the number of deals closed, you’ll get an idea of the percentage of qualified leads that actually become customers. Posting engaging content regularly using social media scheduler is a great way to promote your product, this way you’ll get a better idea of how this growth could translate into revenue.

You can calculate your LVR by subtracting the number of last month’s qualified leads from this month’s amount of qualified leads, and then dividing that number by the number of last month’s qualified leads, finally, you multiply that number by 100 to get your Lead Velocity Rate percentage.

There are many startup metrics that measure a company's growth, every company is different and everyone wants to achieve success, but you need to keep in mind that fast growth doesn’t mean you’ll achieve success and stay there for good; maybe a more gradual growth will let you see every aspect of your startup company’s progress and detect what needs change in order to achieve real success. If you’re building your Startup, we invite you to read our “Common Startup Problems and How to Avoid Them” article so you can prevent other mishaps!

Photo credit - master1305

- Relevant

- Recent

- Topics

- Archive

- April 2023 (1)

- March 2023 (1)

- June 2022 (1)

- May 2022 (3)

- April 2022 (3)

- March 2022 (5)

- February 2022 (2)

- January 2022 (3)

- December 2021 (3)

- November 2021 (4)

- October 2021 (5)

- September 2021 (8)

- August 2021 (7)

- July 2021 (2)

- June 2021 (3)

- May 2021 (5)

- April 2021 (8)

- March 2021 (4)

- February 2021 (3)

- January 2021 (3)

- December 2020 (6)

- November 2020 (9)

- October 2020 (1)

- September 2020 (5)

- August 2020 (4)

- July 2020 (1)

Discover More Hirebook Posts

.jpg)